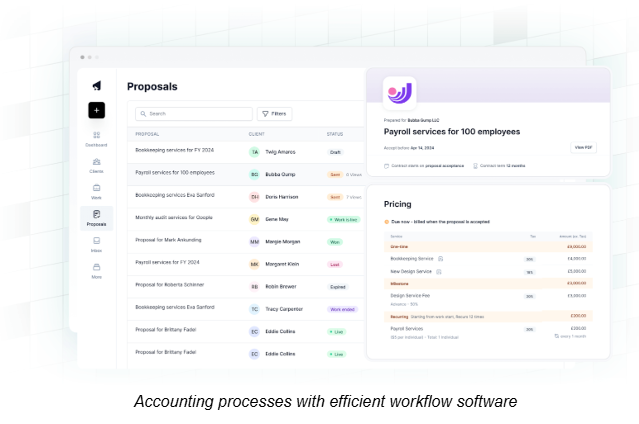

In the ever-evolving accounting industry, efficiency is key. As firms expand, managing client accounts, meeting deadlines, and staying compliant can become overwhelming. This is where workflow software for accountants comes into play. It is designed to simplify complex processes, allowing accountants to automate tasks, track progress, and collaborate more effectively. By incorporating such software into their daily practices, accountants can significantly enhance their productivity, reduce errors, and focus more on providing valuable financial insights to their clients.

Automating Repetitive Tasks

One of the standout features of workflow software for accountants is its ability to automate repetitive tasks that traditionally consume significant amounts of time. Tasks such as invoice generation, data entry, report preparation, and even tax calculations can be streamlined. This frees up accountants from the mundane, letting them focus on higher-value activities like advising clients on financial strategies or analyzing trends in financial data. With fewer manual processes, the risk of errors is minimized, leading to more accurate results and greater efficiency in service delivery.

Enhanced Collaboration Across Teams

Accountants often work in teams, especially in large firms or during busy tax season. Effective collaboration is essential for maintaining smooth operations and meeting tight deadlines. Workflow software for accountants provides a platform where team members can share files, assign tasks, and track progress in real time. This central hub ensures that everyone is on the same page, eliminating confusion and keeping projects on track. Whether it’s reviewing financial statements or preparing tax returns, all stakeholders can stay informed and engaged, improving overall team synergy and accountability.

Managing Client Expectations

Client relationships are the foundation of any accounting firm. Meeting deadlines and maintaining clear communication are vital to keeping clients satisfied. With workflow software for accountants, client expectations can be better managed. The software helps track deadlines, send reminders for overdue tasks, and ensure that nothing falls through the cracks. Furthermore, some platforms allow for client portals, where clients can directly access their financial documents and updates. This reduces the back-and-forth and ensures that clients always have the latest information at their fingertips, improving overall satisfaction.

Real-Time Reporting and Analytics

In accounting, the ability to quickly generate reports and analyze data is crucial. Workflow software for accountants not only automates the creation of financial reports but also enables accountants to pull up real-time data from across the firm. With customizable dashboards, accountants can monitor key performance indicators, track ongoing projects, and make data-driven decisions quickly. The ability to view up-to-the-minute information ensures that decisions are based on the most current data, reducing risks and improving the quality of advice given to clients.

Scaling with Your Firm’s Growth

As an accounting firm grows, its processes must scale to handle more clients and increased workloads. Workflow software for accountants is flexible enough to grow with your firm. Whether your firm has one accountant or a hundred, the software can be adapted to meet the evolving needs of the business. By automating more functions and improving task management, it helps firms manage the additional workload without sacrificing quality or customer service. The scalability of this software means that it continues to provide value even as your firm expands and takes on more clients.

Improved Compliance and Risk Management

Staying compliant with industry standards and regulations is a constant challenge in accounting. Workflow software for accountants provides tools that help automate compliance checks, track regulatory deadlines, and ensure that all necessary documentation is properly stored. With the software’s built-in audit trails, firms can easily trace the history of each document and action taken, providing transparency and reducing the risk of penalties. This not only helps with regulatory compliance but also improves the firm’s credibility and reputation for reliability.

Boost team collaboration and accuracy using workflow software for accountants

Time Management and Efficiency

Effective time management is essential for success in accounting. With numerous tasks to handle, prioritizing becomes critical. Workflow software for accountants helps accountants manage their time more efficiently by providing tools to organize tasks, set deadlines, and allocate time for each project. Automated reminders help prevent missed deadlines, and time-tracking features ensure that billable hours are properly accounted for. By improving time management, accountants can optimize their workload and reduce stress, leading to better work-life balance and more productive days.

Integrating with Other Accounting Tools

Many accounting firms already use a variety of software tools, from tax software to financial management platforms. Workflow software for accountants can integrate with these tools to provide a seamless experience. Integration means that data flows smoothly from one system to another, eliminating the need for manual data entry and reducing the chances of errors. Whether it’s syncing client data or pulling information from financial software, integration helps streamline processes and ensures that all tools work together efficiently.

Workflow software for accountants offers a comprehensive solution to the challenges faced by modern accounting firms. By automating tasks, improving collaboration, enhancing client communication, and ensuring compliance, this software helps accountants work smarter, not harder. Whether you’re a small firm or a large practice, workflow software is an investment that improves productivity, reduces errors, and provides better service to clients. As the accounting industry continues to evolve, embracing such technology will be key to staying ahead of the competition and delivering top-notch financial services.